The Employee Wellness Programme (EWP) at the Durban University of Technology (DUT) hosted a webinar on Planning Your Money For A Post-Pandemic World, to enlighten DUT staff on how to take control of their financial future on Microsoft Teams, on Tuesday, 13 October 2020.

This eye-opening webinar was facilitated by EWP manager, Samantha Rajcoomar and the main speaker was a certified Financial Planner, Luke Howard from PSG Wealth.

“As we all know COVID-19 has been an unprecedented event and the financial ramifications will forever remain edged in our lives. This event has actually plunged the country into a long term financial dip and has no doubt jeopardised the financial future for all of us. Millions of people in South Africa and even globally have become subject to significant financial stress, anxiety, uncertainty, debt, emotional and mental health problems now more than ever,” said Rajcoomar.

She said while some factors affecting financial well-being are beyond the people’s control, financial knowledge can help them better manage their finances through times of hardships.

Howard specialises in helping individuals to identify what is most important in their lives and design a plan that takes them from their current position to where they want to be in the future.

His main focus was on how people can reset their financial health, how the pandemic impacted their investments, what does the individual’s retirement picture look like now and what can people do to position themselves for their future money success.

He said it is important for people to recheck their financial health because financial stress is one of the biggest stresses that people can have and it does play itself out in other areas of their lives.

According to Howard, COVID-19 has helped people to take a step back and think about what is really important to them.

“Many people were thinking; do we need to have two cars? Do we miss eating out? All these things heightened those things that are truly important to us. These are the things I want us to think about. Is that the thing important to you is making sure that you have a solid retirement? Is that thing making sure that your son or daughter goes to the absolute best school? Is it having the best car or traveling the world? What are those things that are important to you?” asked Howard.

Advising the DUT community on how to spend money wisely, Howard said people should try the concept of money dials, which is to turn the volume up on the areas on your life that you love to spend your money on.

He stated that money is hard earned, people work hard for it so it is good that they find ways to spend it on the things that they really love.

“Turn the dial down on things that are not important and turn the dial up on things that are important. If you really love cars go and get the latest best car and maybe don’t go on as many holidays or live in a smaller apartment or don’t eat out as much. Critical steps in getting out of this pandemic is to assess the damage. Know where are you today? Assess your retirement picture. Look at what debts you have and start to tackle one debt at a time. It will give you a psychological boost as you knock off one instead of paying all of them an equal amount. Also draw the cash out for flexible spending to spend money wisely,” advised Howard.

Determining good and bad debts is also one of the ways that Howard said people can use to assess their financial health.

He defined good debts as those when you borrow money for something that appreciates, in order words borrow money to buy property, the property value should get more. As for bad debts he said those are when you borrow money for something that is going to depreciate in value, for example a vehicle, it loses its value from 20% to 30% a year.

“Smash the bad deaths first in order or priority, technically the one with the highest interest rates which will be your credit cards. Try to do one at a time so you get the emotional benefit of getting rid of them and then at the end you can only have the good debts,” stated Howard.

Speaking on investments, Howard said the share market took a massive drop during lockdown but has just about recovered to where it was which is remarkable since it fell by 30% at one point.

He said if people had money in South African shares, they would have had a massive drop but, if they did not do anything at that point in time, they would have recovered by now. He advised people to consider global investments which have a higher interest rate.

Furthermore, he advised people to not only focus on life cover investments and not to forget to invest in their retirement fund, to ensure that they are taken care off when they retire.

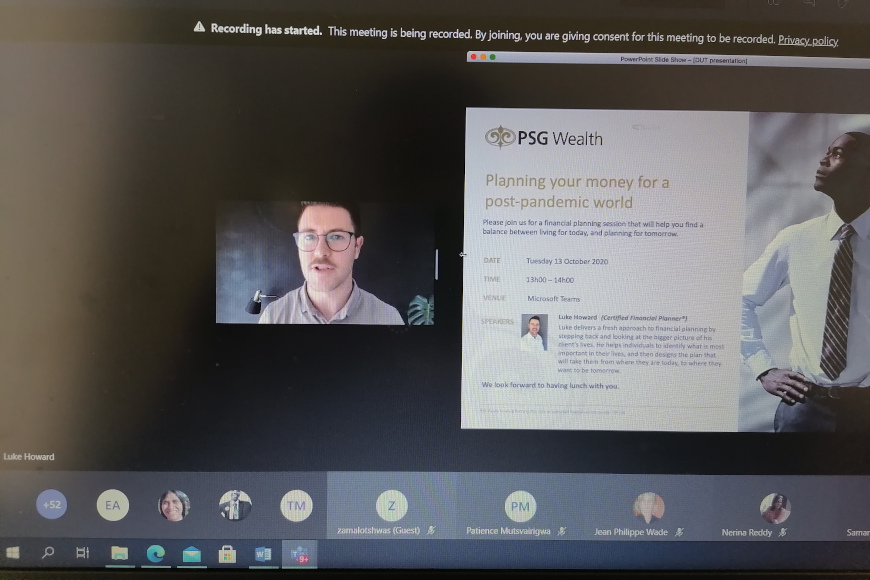

Pictured: Financial Planner, Luke Howard advising DUT staff on taking control of their financial future

Simangele Zuma