The Employee Wellness Programme (EWP) at the Durban University of Technology (DUT) recently hosted a wellness webinar titled: The Financial Habits of the Successful: Manage Your Money to Live Your Best and Rich Life, which was held on Microsoft Teams.

This webinar was facilitated by EWP manager, Samantha Rajcoomar and the main speaker was a certified Financial Planner, Luke Howard from PSG Wealth.

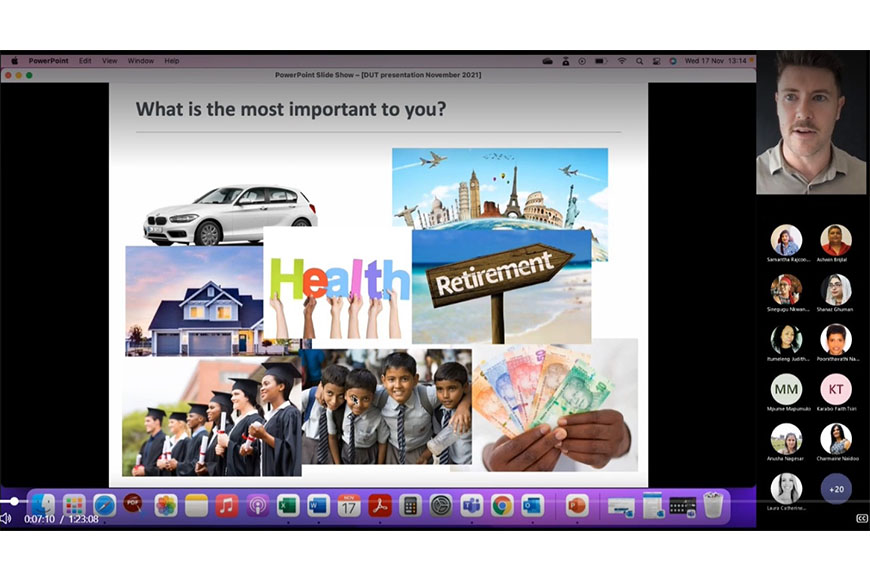

Howard spoke on the regular questions asked by clients regarding financial planning, such as what percentage should an individual be saving for retirement, the amount that a person should spend on a house or how much should one have in savings.

“It used to be very much just a cookie cutter approach to financial planning where people wanted to just tick a box that they felt like they did the right thing but what has happened now is that financial planning has evolved into more about you deciding what is important to you. We (Financial Planners) help to build or facilitate in that by way of structuring your investments or your retirement planning or your life policies or those financial products.

We then align those to what is most important to you,” he stressed.

Howard mentioned different things are important to different people and spoke on things that inspire people and motivate them which, he relayed is a far better conversation than often the doom and gloom that gets associated with money and finances.

“Finance tends to bring on so much anxiety and stress and so many of the negative emotions and my mission is to try and empower you and encourage you to change the focus to the positives, to the important things to you and the joy of what wealth and money and finance can be, instead of focusing on all the things that could go wrong and the stress and the worry,” he said.

According to Howard, there are two types of people that he has found when it comes to personal finance and gravitate towards. “One is what we would term a spender and one is what we term a saver. The saver is the type of person who feels good from having money. A clear example is myself, not my wife and I enjoy it when I open my bank account and I see that there’s an X amount of money just lying there. It gives me a sense of security and peace and I enjoy having the money. Whereas my wife, for example, she gets joy or satisfaction from spending money and this is not legitimately how she is. So, to bring a bit more awareness to you is to also overlay this thinking where you know which camp do you find yourself in and to just notice it, just become aware of your tendency in that area and to try and see what is on the other side,” said Howard.

He indicated that for himself he needs to be a little bit more comfortable spending money and does need to have thousands of rands sitting in his bank account necessarily.

“The bank is not going to break, whereas with spenders like my wife, they need to also realise that you don’t have to spend if there’s 100’s of rands in your account. You will be ok if you don’t spend your whole salary this month,” he said.

Howard urged attendees to think about what they want their future lifestyle to look like.

“Gather your financial information, go and meet with your financial planner and have a conversation with them. Speak about these ideas with and ask them questions and start designing your future,” he said.

Giving the vote of thanks, Rajcoomar expressed her heartfelt thanks for the valuable session.

“I myself thoroughly enjoyed it personally and professionally and I’m going to definitely have you back in the new year,” she said.

Pictured: Financial Planner, Luke Howard highlighting the importance of financial planning to DUT attendees at the wellness webinar.

Waheeda Peters